Amanita Muscaria Mikrodawkowanie

Mikrodawkowanie Amanity Muscarii budzi wiele pytań. Sprawdź, jakie korzyści i zagrożenia niesie ze sobą mikrodawkowanie muchomora czerwonego.

Shroomsy

Dostarczamy swieże, najwyższej jakości growkity grzybów psylocybinowych czyli odmiany psilocybe cubensis. Eksploruj razem z nami świat magicznych grzybów.

169 PLN

169 PLN

169 PLN

289 PLN

“Psychodeliki pokazują ci, co siedzi w twojej głowie, te podświadome myśli i uczucia, które są ukryte, zakryte, zapomniane, poza zasięgiem wzroku, może nawet zupełnie nieoczekiwane, ale mimo to nieuchronnie obecne. ”

“Jestem przekonany, że psychodeliki nie są panaceum, ale mogą odegrać rolę w uzdrawianiu i tworzeniu więzi, zarówno dla osób, które zdecydują się ich używać, jak i dla tych, które tego nie zrobią.”

“Najważniejszą rzeczą, jaką według mnie odkryłem w przypadku psilocybiny, jest to, że nie jesteśmy przywiązani do ciała. Nie ma końca. Nie ma śmierci. Świadomość trwa i jest to podróż i eksploracja.”

“Jedna psychodeliczna podróż może sprawić, że zrozumiesz więcej o naturze rzeczywistości niż tysiące godzin „robienia” nauki.”

“Umysł jest potężnym narzędziem, a psychodeliki mogą pomóc nam wykorzystać jego pełny potencjał.”

“Psychodeliki są tym, czym mikroskop dla biologii, a teleskop dla astronomii.”

“Psychodeliki są katalizatorami głębszego zrozumienia umysłu i świadomości.”

“Doświadczenie psilocybinowe może pomóc nam uzyskać dostęp do części nas samych, które zwykle są ukryte przed wzrokiem.”

“Chociaż wielu z nas uważa psychodeliki za niebezpieczne narkotyki, czas to przemyśleć. Są nietoksyczne, nie uzależniają, mają bardzo niewiele skutków ubocznych i mogą potencjalnie przynieść ulgę osobom cierpiącym na szereg problemów psychologicznych.”

“Doświadczenie psychodeliczne jest bramą do wyższego stanu świadomości.”

“Doświadczenie psilocybinowe jest sposobem na połączenie się ze światem przyrody i głębsze docenienie naszego w nim miejsca.”

“Istnieje świat poza naszym, świat daleki, bliski i niewidzialny.”

“Jestem za psychodelikami, ale trzeba mądrze podchodzić do wszystkiego, co się bierze. To nie jest dla każdego i to jest w porządku. Możesz nauczyć się otrzymywać te same korzyści co z grzybów poprzez inne alternatywy np. takie jak medytacja”

“To nie jest tak, że machniemy magiczną psychodeliczną różdżką i rozwiążemy wszystkie nasze problemy, ale jest to naprawdę ważne narzędzie, które warto mieć w swoim zestawie.”

“Psilocybina może pomóc nam przełamać bariery między nami a innymi oraz rozwinąć poczucie empatii i współczucia.”

Mikrodawkowanie Amanity Muscarii budzi wiele pytań. Sprawdź, jakie korzyści i zagrożenia niesie ze sobą mikrodawkowanie muchomora czerwonego.

Shroomsy

Amanita Muscaria czyli Muchomor Czerwony - obalamy mity i sprawdzamy fakty oraz jego właściwości i działanie.

Shroomsy

Czy "bad trip" to tylko zła przygoda, czy może szansa na wgląd i rozwój? Poznaj objawy, przyczyny i sposoby radzenia sobie z tymi trudnymi doświadczeniami.

Shroomsy

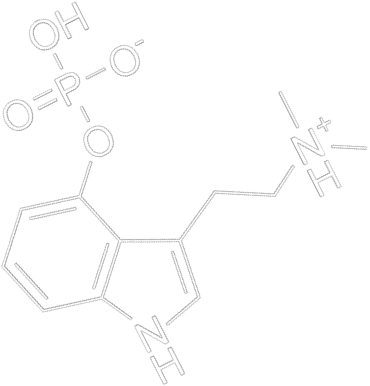

Psilocybe Cubensis, nazywane również popularnie grzybami psylocybinowymi lub potocznie grzybki halucynki stanowią wyjątkowy element świata grzybów. Te fascynujące organizmy rozwijające się w naturze, zawierają substancję zwana psylocybiną, która jest kluczowym czynnikiem mającym silne oddziaływanie na ludzki umysł i świadomość.

Warto wiedzieć, że Psilocybe Cubensis to gatunek grzybów, który od dawna przyciąga uwagę zarówno naukowców, jak i pasjonatów przyrody. Są one znane ze swojego charakterystycznego wyglądu i zdolności wytworzenia substancji psychoaktywnej. To właśnie ta substancja jest głównym składnikiem, który wzbudza zainteresowanie i ciekawość wielu badaczy oraz lekarzy.

Psylocybina i grzyby są przedmiotem badań naukowych na całym świecie. Warto bowiem zwrócić uwagę na to, że prace badawcze nad psylocybiną prowadzone są kontekście leczenia chorób i zaburzeń psychicznych - duże nadzieje kładzie się w leczeniu uzależnień oraz PTSD.

Niezależnie od rodzaju, grzyby psylocybinowe zawierają substancje psychoaktywne, takie jak psylocybina i psylocyna. To właśnie te związki chemiczne mogą wpływać na ludzki umysł. Jednak warto zaznaczyć, że działanie grzybów jest złożone i zależy od wielu czynników. Psylocybina wytwarzana przez grzyby wciąż jest przedmiotem badań.

Indywidualna wrażliwość oraz otoczenie, w jakim się znajdujemy, mogą wpłynąć na przebieg doświadczeń. Ich spożycie wpływa na funkcje poznawcze, oddziałuje na receptory serotoninowe i może wywoływać halucynacje, choć uważamy że termin doświadczenie psychodeliczne jest tu bardziej na miejscu.

Grzybki psylocybinowe można obserwować lub badać, jednak przed rozpoczęciem jakichkolwiek działań, należy zapoznać się z przepisami prawnymi obowiązującymi w danym państwie

Grzyby psylocybinowe występują w wielu gatunkach. Choć Psilocybe Cubensis stanowią jedną z najbardziej rozpoznawalnych i szeroko dostępnych odmian, istnieje wiele innych rodzajów grzybów, które również wytwarzają substancję psychoaktywną o nazwie psylocybina. Warto wiedzieć, że bogactwo świata tych organizmów jest niezwykle różnorodne.

Oprócz Psilocybe Cubensis, które często stanowią wejście w świat grzybów psylocybinowych dla wielu badaczy i pasjonatów, spotykamy również takie odmiany jak Psilocybe Mexicana, Psilocybe Azurescens, Psilocybe Semilanceata, Psilocybe Cyanescens i inne.

Poszczególne grzyby halucynogenne mają swój niepowtarzalny charakter - od odmiennej kolorystyki, przez różnice w zawartości substancji psychoaktywnych, po inne warunki występowania.

Badając różnorodność grzybów psylocybinowych, możemy odkrywać ich unikalne właściwości, morfologiczne cechy jak struktura i budowa, a także przyczyniać się do lepszego zrozumienia, jak wpływają na ludzki umysł i jakie mają potencjalne zastosowania. Grzybki psylocybinowe można zatem badać w wielu aspektach.

W świecie badaczy i pasjonatów grzybów psylocybinowych growkity stanowią niezwykle użyteczne rozwiązanie. Czym jest growkit? Jest to odpowiednio przygotowana grzybnia grzybów halucynogennych, która umożliwia hodowlę w dowolnym miejscu. To rewelacyjne narzędzie, które pozwala kontrolować cały proces od początku do końca.

Grzyby psylocybinowe grzybnia - czy jest to zgodne z prawem? Warto podkreślić, że zakup i posiadanie growkitów jest legalne w wielu krajach. W Polsce ich posiadanie nie jest zabronione, jednak nie można dopuścić do powstania owocników.

Grzybnia psilocybe to doskonała alternatywa dla osób, które chcą eksplorować świat grzybów psylocybinowych w sposób bezpieczny. Podkreślamy jednak, że zawsze przed zakupem należy zapoznać się z obowiązującym w danym regionie prawem i przepisami regulującymi kwestie posiadania grzybni.

Growkity dają też kontrolę nad całym procesem badań lub obserwacji. Shroomsy.pl to sklep internetowy, w którym znajdziesz najwyższej jakości growkity. Kupisz u nas między innymi growkit Golden Teacher, McKennaii, Hawaiian, Thai i wiele innych. Naszym atutem są dokładnie przygotowane i wyselekcjonowanie grzybnie, ale też korzystna cena.

W Shroomsy.pl staramy się zapewnić naszym klientom konkurencyjne ceny, aby były one dostępne dla jak najszerszego grona badaczy i pasjonatów. Jednak warto podkreślić, że cena to tylko jeden z wielu czynników, które należy wziąć pod uwagę przy wyborze produktu.

Kluczowa jest bowiem jakość grzybni i przygotowanie growkitu. Nasze growkity to kompletne zestawy, w których znajduje się plastikowe pudełko zawierające grzybnię, kartonowe opakowanie, plastikowa torba z filtrami powietrza oraz dwa spinacze do papieru. Grzyby halucynogenne - grzybnia kompletna i gotowa do rozpoczęcia obserwacji? Znajdziecie to w naszej ofercie.

Psilocybe Cubensis, czyli popularnie zwane magiczne grzybki to fascynujący element przyrody, który może dostarczyć niezapomnianych doświadczeń podczas obserwacji lub badań. Jednakże, eksplorując ten niezwykły świat, zawsze zachowuj ostrożność, respektuj prawo i zdobywaj wiedzę w kontrolowany sposób. Pomogą Ci w tym growkity od Shroomsy.pl.

Jesteśmy renomowanym dostawcą, który dba o najwyższą jakość oferowanych produktów. Sprawdź growkity dostępne w naszym sklepie - jeżeli chcesz wiedzieć więcej o prezentowanym asortymencie, zapraszamy do kontaktu.

Grzyby halucynogenne - jak wygląda kwestia prawna? Zanim rozpoczniesz badania nad grzybami psylocybinowymi, konieczne jest dokładne zapoznanie się z obowiązującym prawem w swoim kraju.

Przepisy dotyczące grzybów halucynogennych różnią się w zależności od regionu, co sprawia, że jest to kluczowa kwestia do rozważenia. W niektórych krajach grzyby halucynogenne są całkowicie legalne i nie podlegają restrykcjom prawnym. Jednak w innych miejscach mogą istnieć surowe przepisy regulujące ich posiadanie lub hodowlę. Dlatego zawsze warto zorientować się, czy prowadzenie badań nad tymi grzybami jest zgodne z miejscowymi przepisami.

Grzybki halucynki w Polsce są zakazane. Oznacza to, że ich posiadanie i uprawa stanowią naruszenie obowiązującego prawa. Zgodnie z polskimi przepisami, grzyby halucynogenne są uważane za substancje psychotropowe i znajdują się na liście zakazanych substancji.

Posiadanie, uprawa, handel, a nawet samo zbieranie tych grzybów może skutkować poważnymi konsekwencjami. Można natomiast posiadać growkity, nie dopuszczając do powstania owocników. Nie ma więc żadnych przeciwwskazań do ich zakupu.

Psilocybe Cubensis to bardzo ciekawe organizmy, nic więc dziwnego, że coraz częściej prowadzi się nad nimi badania. Growkity będą niezbędnym elementem takich obserwacji. Shroomsy.pl to miejsce, gdzie znajdziesz szeroki wybór wyselekcjonowanych growkitów - odpowiednio przygotowanych i spełniających najwyższe standardy jakości.

Naszym celem jest zapewnienie klientom dostępu do narzędzi i surowców, które pozwolą im na prowadzenie badań oraz eksplorację grzybków halucynogennych w sposób bezpieczny i odpowiedzialny. Grzyby psylocybinowe i ich szerokie właściwości odkryjesz dzięki Shroomsy.pl

Psilocybe Cubensis są przedmiotem badań i obserwacji wielu osób. Wymagają odpowiedniego przygotowania, znajomości niezbędnych zasad i obowiązujących przepisów prawnych. Szeroką grupę badawczą stanowi branża medyczna, ponieważ grzyby psylocybinowe od lat sprawdza się pod kątem ich korzystnego działania na zaburzenia psychiczne.

Jednak aby prowadzić badania nad nimi, konieczne jest posiadanie odpowiedniego materiału do analizy, czyli grzybni w postaci growkitu. To właśnie ona umożliwia stworzenie hodowli, która będzie później podstawą do niezbędnych obserwacji. Nasz sklep oferuje grzybnie wysokiej jakości, które doskonale sprawdzą się w badaniach.

Psilocybe Cubensis od lat przyciągają uwagę ze względu na potencjalne korzyści z ich zastosowania w leczeniu zaburzeń psychicznych. Grzybnia w postaci growkitu staje się kluczowym narzędziem dla tych, którzy pragną zgłębić tajemnice i potencjał leczniczy tych grzybów.

Jednym z interesujących rodzajów grzybów psylocybinowych jest Psilocybe Semilanceata, znana również jako łysiczka lancetowata. To gatunek grzyba, który występuje w różnych regionach świata i charakteryzuje się znaczną zawartością psylocybiny. Grzyb ten jest szczególnie popularny w niektórych częściach Europy i stanowi przedmiot badań ze względu na swoje unikalne właściwości psychodeliczne.

Obserwacja Psilocybe Semilanceata może dostarczyć cennych informacji na temat składu chemicznego, działania na organizm ludzki oraz potencjalnych zastosowań w medycynie czy psychoterapii. Warto jednak pamiętać, że badania nad grzybami psylocybinowymi, w tym łysiczką lancetowatą, wymagają odpowiednich uprawnień i przestrzegania przepisów prawa.

Towar prezentowany na stronie Sklepu internetowego www.shroomsy.pl stanowi wyłącznie grzybnię, która przeznaczona jest do prowadzenia badań mikroskopowych. Sama grzybnia nie zawiera substancji psychoaktywnych i nie powinna być wykorzystywana do innych celów niż badania naukowe.

Wszystkie informacje oraz zdjęcia dotyczące oferowanych produktów pochodzą od oryginalnych producentów (Holandia) i służą wyłącznie celom edukacyjnym, nie są zachęta do łamania prawa.

Zgodnie z ustawą z dnia 29 lipca 2005 r. o przeciwdziałaniu narkomanii zakazane jest m.in. posiadanie, wytwarzanie i przerabianie substancji psychotropowych, do których zalicza się zarodniki grzybów psylocybinowych. Za niniejsze czyny ustawa przewiduje odpowiedzialność karną w postaci grzywny, kary ograniczenia wolności lub pozbawienia wolności.